The global shift towards digital identification systems provides MNOs, OEMs, service providers and governments with the opportunity to act as main accelerators of this trend. All of these want to make digital identity and online services defining features of their digital transformation processes in the years to come. MNOs’ traditional sources of revenue have been challenged by the rapidly changing environment and now they are trying to adapt by claiming a new territory in the digital market.

Before we dive into the key trends driving trusted digital identities for MNOs and OEMs, let’s first define what a digital identity is.

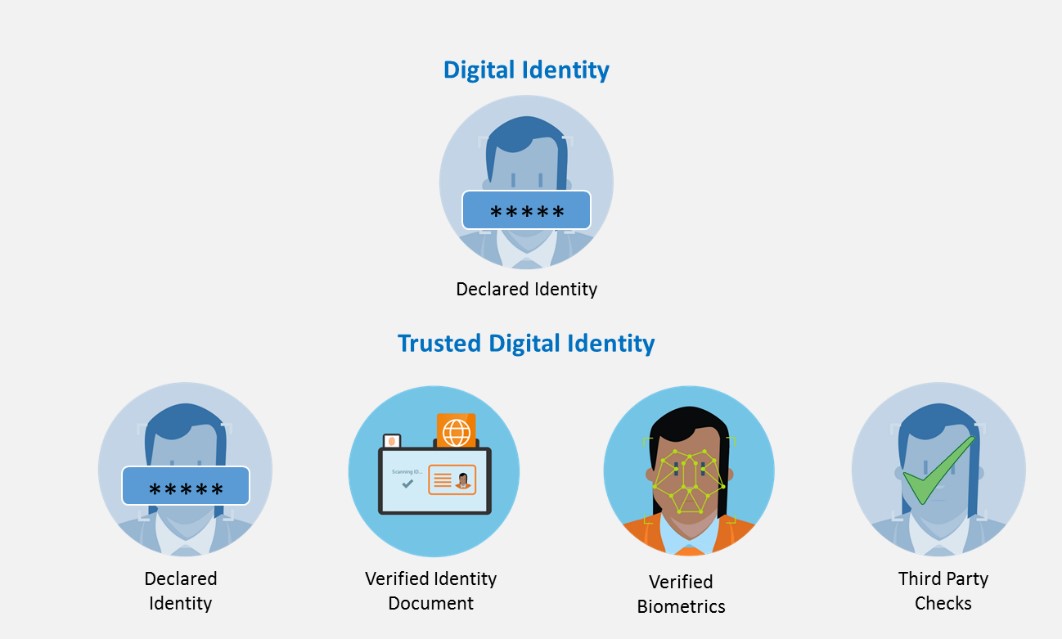

What is a digital identity?

Digital identity is the technological link between a real entity such as a person and its digital equivalent entities. It includes a collection of electronically captured and stored identity attributes including biographic and biometric data, and something the person has—like a smartphone—that can uniquely describe a person within a given context.

People own many digital identities that consist of an email address and a password to access different online services. In some cases, such as engaging with media or entertainment, we prefer for these identities to be fake or just blurry.

But in the case of important interactions and transactions conducted online, such as with your government or bank, it’s critical that you are who you claim to be. The same applies to our mobile phones: as a near-indispensable extension of ourselves that holds our most security-sensitive information. It’s important that the identity connected to that phone is real and verifiable.

Trusted Digital IDs are created when the information provided has been verified or checked for authenticity. A trusted digital ID consist of a set of verified attributes (like verified ID documents or biometrics), thus providing a certifiable link between an individual and their digital identity. These attributes may include also verification with third parties like Government databases, social identity, credit card numbers, mobile records, etc.

Technology is in the heart of enabling trusted digital IDs, helping governments, service providers and other players in the ecosystem create a trusted digital security. Different possibilities are being deployed such as centralized government infrastructure or corporate identities, showing us the fast pace this technology is developing with and its huge implications.

In contrast to the insecure username and password combination, a trusted digital ID is created with a verified identity document, thus providing a certifiable link between an individual and their digital identity.

Trusted digital IDs provide value through secure access to services and improve the customer experience, because they serve as a gateway for customers to access multiple, security-sensitive services like:

- prepaid and postpaid, mobile money, device swap, IoT services from mobile operators

- Banking, eCommerce, online bills payment, money transfers from financial services providers

- eVoting, tax payment, eSocial services, Insurance, eHealth, Social Security via eGovernment services

There are 5 key trends driving trusted digital identity, which we’ll explore below.

-

More mobility and convenience

Today’s customers are able to access services remotely online without having to go to physical branches. In order to provide a seamless omni-channel experience that is convenient and also secure, implementing trusted digital IDs is a must.

In fact, according to a recent Gemalto research, 70% of users would like to have trusted digital IDs, and 66% of them would use them to perform more transactions.

-

Greater demand for security and trust

According to the 2017 CFCA Global Telecom Fraud Loss Survey, $2bn has been lost annually to identity-based telecoms subscription fraud. Additionally, following the significant cyberattacks we witnessed in the last few years, 43% of users claim they fear fraud, phishing, hacking and getting their personal information stolen.

It’s clear that consumer awareness of security and privacy is increasing, making regulators, MNOs, manufacturers and service providers more concerned about providing the right protection for connected devices, and the data they collect, share and store.

This means that the demand for security and trust is greater than ever before. So, robust security measures will be the obvious response to new demands for trust in all exchanges between users and mobile service providers. Failing to address these demands, the cost of fraud would fall beyond direct costs and would damage the brand image of any affected company.

-

New regulations

As new regulatory environments take shape, close collaboration between the financial world, central and local public authorities and digital communications operators will support effective solutions and implementation of best practices.

The focus will be on the adoption of the new structures and regulations that are needed to govern the associated services and transactions. There already are a few regulatory structures shaping the way MNOs and financial services providers are using trusted digital identities. For example:

- SIM registration regulation imposes stricter ID verification procedures for postpaid and prepaid

- Organizations offering financial services need to comply with anti-money laundering (AML) and anti-terrorism (CFT) legislation leading them to follow a client identification procedure of Customer Due Diligence (CDD) or Know Your Customer (KYC).

- eIDAS European regulation for the electronic identification and trusted services for electronic transactions

-

Shift towards digital identification systems

The importance of user acceptance and trust was revealed in a recent survey, where users expressed concerns with pairing social media credentials with something as important as your bank account. However, it looks like some social media players have taken this into consideration and are also looking at more secure digital IDs. For instance, Facebook recently acquired a startup for ID verification that allows other companies to verify a user’s government-issued identification card.

Other stakeholders such as smartphone manufacturers, MNOs, governments and financial institutions are also shifting towards digital identification systems to provide trust and convenience for citizens using their services. These cases are security-critical and require trusted digital ID. Therefore, established security companies are more likely be delivering these digital services, because they have already established trust with consumers.

-

The technology

New technologies have emerged to support and shape government and private company digital transformation. Here are some notable examples of digital transformation initiatives, where trusted digital IDs are in the heart of the service:

- Digital driver’s license projects gathered momentum in countries including the USA, UK, Australia and the Netherlands

- Early tests of blockchain technologies took place in Estonia to aid development of a ground-breaking transnational e-residency program

- Smart borders/smart airports emerged at a faster pace. Combined with the 700 million plus ePassports now in circulation, and a strong push behind biometrics, they offered travellers a taste of cross-border movement that is as secure as it is swift and seamless.

Finally, continuous innovations in biometrics, machine learning, and artificial intelligence introduce new and convenient ways of identification.

Find out more from our dedicated infographic.

Our increasingly connected world brings the promise of greater convenience and simplicity, offering people and companies ubiquitous connectivity, along with time savings and improved transparency for better-informed decisions.

You can see how Gemalto helps deploy Trusted Digital Identity strategies and accelerate digital transformation at Mobile World Congress.