The past 12 months have brought a series of exciting technological breakthroughs – Uber testing autonomous cars, Facebook developing cryptocurrency for users to make payments through WhatsApp, and Amazon planning to launch 3000 “Amazon-Go” cashier-less stores by 2021. Game-changing innovation is becoming the norm.

Digital transformation is reshaping industries by disrupting not only existing business or operational models, but by having a profound impact on the way we interact with end-users as a whole. They are now at the center of any innovation. For example, AirBnB, Uber, and Amazon are using existing technologies combined with human-centric design to transform the way consumers interact with service providers.

Service providers including telecoms, banks and retailers, are reshaping their customer engagement strategies due to customer demand. They are looking to deploy solutions that help them deliver seamless experiences across all channels, that are not only personalized but also secure.

In this journey, we are working hand-in-hand with end-users to build the future of customer enrolment and authentication. We help businesses create valuable experiences with their customers, while at the same time streamline manual operations across different geographies and channels.

Simplifying and digitalizing the enrolment process is a must for the digital transformation of industry. This can mean different things depending on regulations, type of service requirements, channel and local specifications. For example, some countries have an official ID document, while others rely only on passports to verify customer identity. In other cases, we might be asked to fill paper forms with our personal details, or we might need to give our consent to check our credit score or validate our address if we’re taking out a loan, mortgage or even buying the latest TV or smartphone on credit plan.

To answer each service provider requirements’, we are developing solutions that combines advanced digital technology, while addressing relevant regulations, user concerns and personalization at the same time.

“I try to put the customer in confidence and reassure him during the subscription steps.”

Emmanuel, in store sales agent

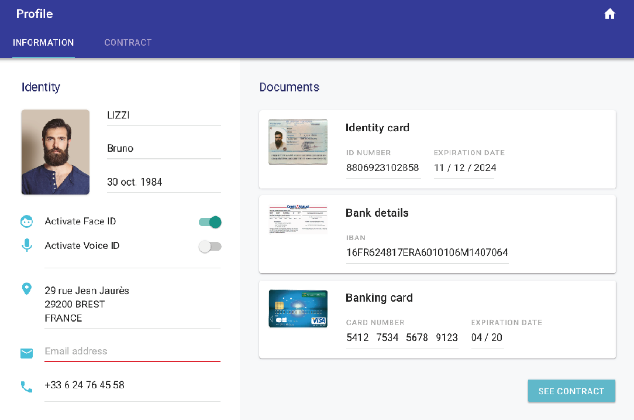

We are helping to digitize customer enrolment process by capturing, verifying and digitizing their identities. Our aim is to automate the enrolment process for end-users at the store or even allow them to enrol from the comfort of their living room.

“We put everything on customer support during the purchase process to meet the expectations of customers.”

David, in store sales agent

We work with customers globally and one of their principal concerns is creating exceptional experiences that comply with the enrolment process. To avoid customer frustration, we have transformed this process into a fully automatic experience. We’ve done this by addressing the three key elements that have come as most common customer requirements:

- Seamless integration of all enrolment processes including document and data capture, and verification

- Relying on technologies to simplify the set up and avoid technical issues

- Automation to simplify some repeated tasks such as filling and photocopying documents

“I’m here for the customer. Our customers appreciate talking to the same salesperson”.

Jorge, in store sales agent

Our Trusted Digital Identity solution addresses the multiple challenges of streamlining customer on-boarding for service providers by following a simple 3-step process: capture, verify and digitize.

As described in this McKinsey report, arriving at a fantastic design occurs through a great deal of work including revisions, iterations, and seeking out the voice of the user.

A number of critical factors are driving the trend for digitalization of customer enrollment, including compliance with anti-fraud regulations, the search for more streamlined business operations, and customer expectations of a swift and convenient experience across all onboarding channels. What sets Gemalto apart is our ability to orchestrate a highly personalized solution, capturing the identity characteristics required by each particular service provider, addressing relevant legislation, and integrating all the technologies and services needed.

To experience our Trusted Digital Identity demos and speak with our experts, visit us in Hall 2, booth 2J41 at MWC. Let us know if you’ll be there!