For some time now, the ability to accurately and efficiently verify customers’ identities has been growing in importance for mobile operators, especially as levels of fraudulent activity across the globe are on the rise. In fact, the most recent CFCA Global Fraud Loss Survey (2017) revealed that subscription fraud (identity) cost the telecoms industry $2.03bn last year. This figure will undoubtedly rise without significant improvements to customer identity checks/processes. Clearly, significant action is needed; this is where ID verification comes into play.

As a reminder for the uninitiated, reliable Identity Verification services include the following elements:

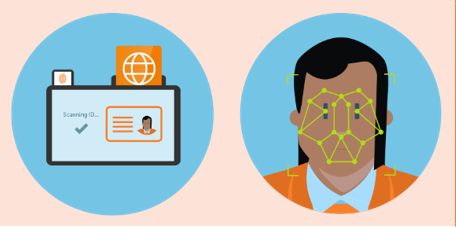

- Capturing attributes as ID documents (such as passports, ID cards, driving licencses, resident permits…) or biometric data (such as fingerprint, facial recognition…)

- Identity document verification – verifying the authenticity of ID documents, such as ID cards, passports, driving licences, resident permits….

- Customer authentication – verifying the identity of the person presenting the ID document by using biometrics or third-party checks (for instance, evaluating the risk linked to a customer through checks on control lists)

- ID verification report – report generation for audit purposes

- Additionally, automatic form filling – easing customer enrollment and limiting human/manual errors

As you might imagine, considering the large amounts of money that are lost to fraud each year, MNOs realize how serious the situation is, and have already started to invest in strong ID verification as a result. But it’s not just about fraud; protecting against fraudulent activity is only one of the key motivating factors. There are many other factors to consider such as regulatory compliance, the enablement of full digital enrolment and access to digital services. Overall, there are at least 10 key reasons for MNOs to invest in stronger ID verification, outlined in a post we shared earlier this year.

However, on this occasion, we’d also like to focus on how important the customer experience is. For example, automatic Identity Verification simplifies processes for customers greatly. This significantly decreases the enrolment time (up to five time faster) thanks to the digitalization of the data capture & verification; we’ve seen strong evidence of this by providing our own Digital ID verification service to Telefónica Deutschland customers.

Working with Telefónica Deutschland

In July 2017, we began working with Telefónica Deutschland to make their ID verification service for their prepaid SIM customers much faster. Since July 2017, in Germany, prepaid SIM customers have been required by law to provide proof of identity; in turn, telecommunications providers must review these documents before approving and activating the SIM card on their network. When approaching this new challenge, Telefónica Deutschland wanted to ensure this process was made as easy and as fast as possible for their customers, hence the move to select a state-of-the-art identity verification service, automating and streamlining their existing process. An image of the customer’s identity document can be captured through multiple channels, in-store by staff or remotely, online, by customers themselves, using a video identification service. The system then compares this image against a constantly updated database of thousands of authentic identity document templates, from Germany and many other countries.

As a result, Telefónica’s prepaid customers can now provide proof of ID in stores, or remotely, more quickly and more securely, than in the past, when the verification process for them would’ve been carried out manually. In any cases, the processes remain the same for customers. So far, the feedback should serve as an example of how this type of system benefits all parties involved, while protecting against fraud primarily. For more detail, make sure you read our case study, followed by the press release

Working with Orange

We’ve also seen some excellent results from our work with France’s leading MNO, Orange, to reduce fraud.

In 2015, Orange’s invoicing and fraud/debt-recovery departments made the important move to improve their ID verification system to deliver a high quality, secure service to its customers. They selected and deployed our automatic, real-time ID Verification solution to help minimize the financial cost of ID fraud, and make sure the best, most efficient verification processes were in place across all their stores. The benefits included a significant reduction in fraud across all their stores, much improved customer care, streamlined customer acquisition, and the simple integration of the system into their IT infrastructure. For more information on how we work with Orange in this area, see our case study.

As you can see from these use cases, automated and strong ID verification services help MNOs protect their customers, revenue and reputation. The benefits are undeniable and improve the experience for provider and costumer alike. Such multi-channel solutions are the first steps for the deployment of Trusted Digital Identities, accelerating the digital transformation of industries and governments and enabling seamless digital customer journeys.

To learn more and discover more about how Identity Verification services for MNOs work, and what’s on offer, please visit our dedicated webpage. And feel free to let us know your thoughts, by tweeting to us with the hashtag #KnowYourCustomerNOW or leave a comment below.